How to safeguard against identity theft in probate

Identity theft is a growing concern in the digital age, and it takes on a whole new dimension when it relates to the probate process. This typically sensitive time, where the assets and belongings of a deceased individual are settled, can also be a window of opportunity for unscrupulous entities intent on exploiting vulnerabilities. To safeguard against this unsettling phenomenon, it is essential to understand both the risks present during probate and the strategies available to mitigate those risks effectively. Understanding how identity theft can occur during this period is vital for personal and financial security.

This article aims to delve into the intricate world of identity theft within the probate context, highlighting the common methods criminals employ to exploit this phase, discussing the signs that might indicate wrongdoing, and providing robust strategies to protect yourself and your loved ones. Additionally, we will explore the legal ramifications and the importance of maintaining a proactive stance during this period. Through focused exploration, we hope to provide you with a comprehensive understanding of how to safeguard against identity theft in probate.

Understanding Identity Theft in the Probate Process

To grasp the full scope of identity theft during probate, it's essential to first understand what identity theft entails, particularly within legal contexts. Identity theft is defined as the unauthorized use of someone else's personal information, often with the intention of financial gain or to commit fraud. In probate, where the estate of a deceased individual is being settled, this type of theft has unique characteristics and pathways. Criminals may use the deceased's identity to access bank accounts, apply for credit cards in their name, or manipulate financial assets.

The probate process becomes particularly vulnerable to identity theft due to the public nature of probate court records. These records often contain sensitive information such as the deceased’s Social Security number, financial accounts, and asset details. Unscrupulous individuals can exploit this publicly available information before family members or the estate executor have time to take protective measures. This makes it imperative for everyone involved to be aware of how these records can be used maliciously and the potential consequences of neglecting to secure personal information adequately.

Common Strategies Used by Identity Thieves

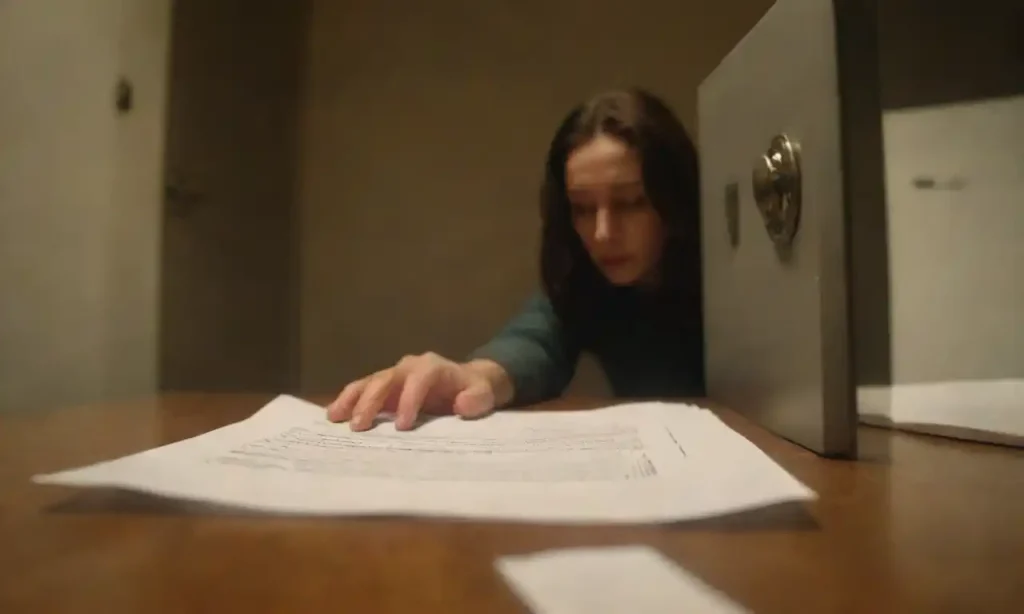

Understanding the tactics employed by identity thieves during the probate process is crucial. While every situation may vary, certain strategies are commonly observed. One frequent method involves document manipulation. Identity thieves may forge or alter documents submitted to probate court, aiming to gain control over the deceased's estate. This includes changing beneficiaries, claiming false debts, or asserting fraudulent ownership of assets. The susceptibility of documentation during this sensitive time can be a major obstacle for grieving families attempting to navigate probate.

Another prevalent method involves leveraging technology to gain access to personal information. Phishing scams have evolved, targeting not only the deceased’s accounts but also their family and friends. Thieves may impersonate legitimate entities, either via email or phone, to glean private information under false pretenses. Often, they create a sense of urgency, claiming that immediate action is required to resolve a fictitious issue related to the deceased’s estate. Family members, caught off-guard by their situation, may inadvertently provide information that compromises their financial security.

Signs of Identity Theft in Probate

Being vigilant and recognizing the signs of identity theft is critical for those involved in probate. One of the first red flags to watch for is unexpected account changes. This may include unfamiliar transactions on bank statements, sudden changes in credit scores, or receiving bills for items you or the deceased never purchased. Monitoring accounts closely during and after the probate process is essential to catch suspicious activities early. Additionally, relatives should keep an eye out for incoming credit offers or applications made in the deceased’s name, as these are often indicative of identity theft.

Another sign of potential identity theft is a lack of communication from legitimate creditors or institutions that historically interacted with the deceased. If, for example, creditors appear uncommunicative about debts or inheritance issues, it could indicate a third party is misleading them by providing false information. Furthermore, the heinous act of receiving communication from debt collectors about fraudulent accounts can also signal that identity theft has transpired. The impact of these signs can be disheartening, particularly during a time of grief, underscoring the need for vigilance throughout the probate process.

Proactive Strategies to Protect Against Identity Theft

Protecting yourself from identity theft in probate requires a combination of legal knowledge and proactive measures. Firstly, it is paramount that all sensitive information related to the deceased is secured promptly. This includes safeguarding any personal documents, such as Social Security cards, bank statements, and wills. Storing these items in a safe place only accessible to trusted family members or legal advisors can minimize the risk of them falling into the wrong hands.

Additionally, consider placing a fraud alert on the deceased's credit reports. A fraud alert notifies creditors to take extra steps to verify identity before opening new accounts associated with that individual. This internal verification can add a layer of security, delaying or preventing identity thieves from generating unlawful credit in the deceased’s name. Also, exploring the option of obtaining a credit freeze can be beneficial; it prevents new accounts from being opened altogether without permission, effectively locking down the deceased’s credit.

Legal Measures and Resources

Dealing with identity theft in probate is not solely a personal concern; it is a legal matter as well. Engaging the services of an attorney who specializes in estate planning and probate can be invaluable. They can provide guidance on the applicable laws regarding identity theft, probate processes, and how to navigate potential disputes concerning the deceased's estate. Furthermore, attorneys can assist in implementing legal actions when identity theft is suspected, such as filing police reports and contacting credit reporting agencies.

There are also resources available through government agencies and nonprofit organizations dedicated to fighting identity theft. The Federal Trade Commission (FTC) offers comprehensive information on recovery steps, including identity theft victim support and resources tailored specifically for handling identity theft within probate situations. Engaging with these resources can empower family members to take the necessary steps to protect their identities effectively and advocate for the deceased.

Final Thoughts on Safeguarding Against Identity Theft

As we navigate the complexities of grief during the probate process, it is crucial to remain vigilant against identity theft that threatens not only the deceased’s legacy but also the financial wellbeing of surviving heirs. Understanding what identity theft entails in this context, recognizing common tactics, and being able to spot signs of fraud are all pivotal steps towards enhancing personal security. Implementing proactive measures can significantly curb the risk and create a barrier against opportunistic fraudsters who may seek to exploit vulnerability in this emotionally charged period.

Ultimately, combining personal vigilance with legal awareness and utilizing available resources will make a profound difference. By fostering an informed approach and prioritizing protective measures, families can honor their loved ones without the cloud of identity theft overshadowing their grief. Amidst navigating the intricacies of probate, remember that knowledge and preparation are your best allies against identity theft. By safeguarding against potential fraud, families can ensure a smoother probate experience while protecting their legacies and financial interests.

Leave a Reply